Free Prenuptial Agreement Form – Download & Protect Your Assets

The “prenup” is a well know joke in marriages. The stigma of this process is very well known and the story behind it is pretty funny. Once upon a time a rich man realized that if he gets married and has a lot of money – his wife can basically try to divorce him and take half his money. Worst than that, he suspected that his wife is only marrying him in the first place to scam him and take his money. And from that, the need for this legal field was born. Prenuptial agreements, often called prenups, are becoming a standard part of wedding planning for many modern couples. This shift reflects evolving societal norms and the increasing complexity of finances within relationships. As a result, conversations about prenups are more common and less stigmatized.

Dispelling the Myths Surrounding Prenups

A common misconception is that prenups are exclusively for the wealthy. This isn’t true. Prenups can be beneficial for couples at all income levels. One key benefit is protecting one partner from taking on the other’s pre-existing debt.

A prenuptial agreement can also clarify financial expectations, which can strengthen a relationship by fostering open and honest communication. This proactive approach to financial planning can help build a stronger foundation for the marriage.

Another myth is that creating a prenup signals a lack of trust. In reality, a well-drafted prenup can increase transparency and prevent misunderstandings about finances. This can help avoid future conflicts and protect both partners’ interests.

The increasing popularity of prenups reflects a growing understanding of their advantages. From 2010 to 2022, the percentage of married or engaged U.S. respondents with prenups rose significantly, from 3% to 15%.

In 2022, 42% of U.S. adults supported the use of prenups, with 35% of unmarried individuals stating they would likely sign one before marriage. This indicates a growing awareness and acceptance, particularly among younger generations who are prioritizing financial planning.

The Reality of Modern Prenups

Today, prenups are viewed as practical tools for financial planning, similar to creating a budget or drafting a will. They offer a way to address potential financial challenges before they arise. This proactive approach can create a stronger foundation for the marriage by promoting open communication and shared financial understanding. This leads to the important question of how to find a reliable and legally sound prenuptial agreement.

Essential Components Every Solid Prenuptial Agreement Needs

A free prenuptial agreement form can be a helpful starting point, but its true effectiveness depends on including the right information. A strong prenuptial agreement must clearly outline the financial situation of both partners. This includes a full disclosure of all assets and debts. This transparency ensures both parties begin the marriage with a complete understanding of each other’s financial standing.

Defining Separate vs. Marital Property

One of the most important functions of a prenuptial agreement is to distinguish between separate property and marital property. Separate property usually includes assets acquired before the marriage, inheritances, and gifts received by one person. Marital property, conversely, refers to assets acquired during the marriage. Clearly defining these categories helps prevent disagreements later. For instance, a family heirloom brought into the marriage would likely be considered separate property. However, a house purchased during the marriage, even if only one spouse is on the title, might be categorized as marital property depending on state laws.

Debt Allocation and Protection of Business Interests

A solid prenup should also address how pre-existing debt will be handled. It should state which partner is responsible for which debts, preventing one spouse from being held liable for the other’s financial obligations. If one partner owns a business, the prenup can protect that business in the event of a divorce. This is essential for safeguarding investments made before the marriage and protecting future earnings.

Addressing Retirement Accounts, Children, and Other Considerations

Retirement accounts, often a significant asset, should be included in the agreement. The prenup can specify how these accounts will be divided in a divorce. If children are part of the family plan, the prenup cannot determine child support or custody. However, it can address other aspects related to children, such as paying for future education. Some couples even include provisions for pets, outlining who will care for them and cover related expenses if the relationship ends.

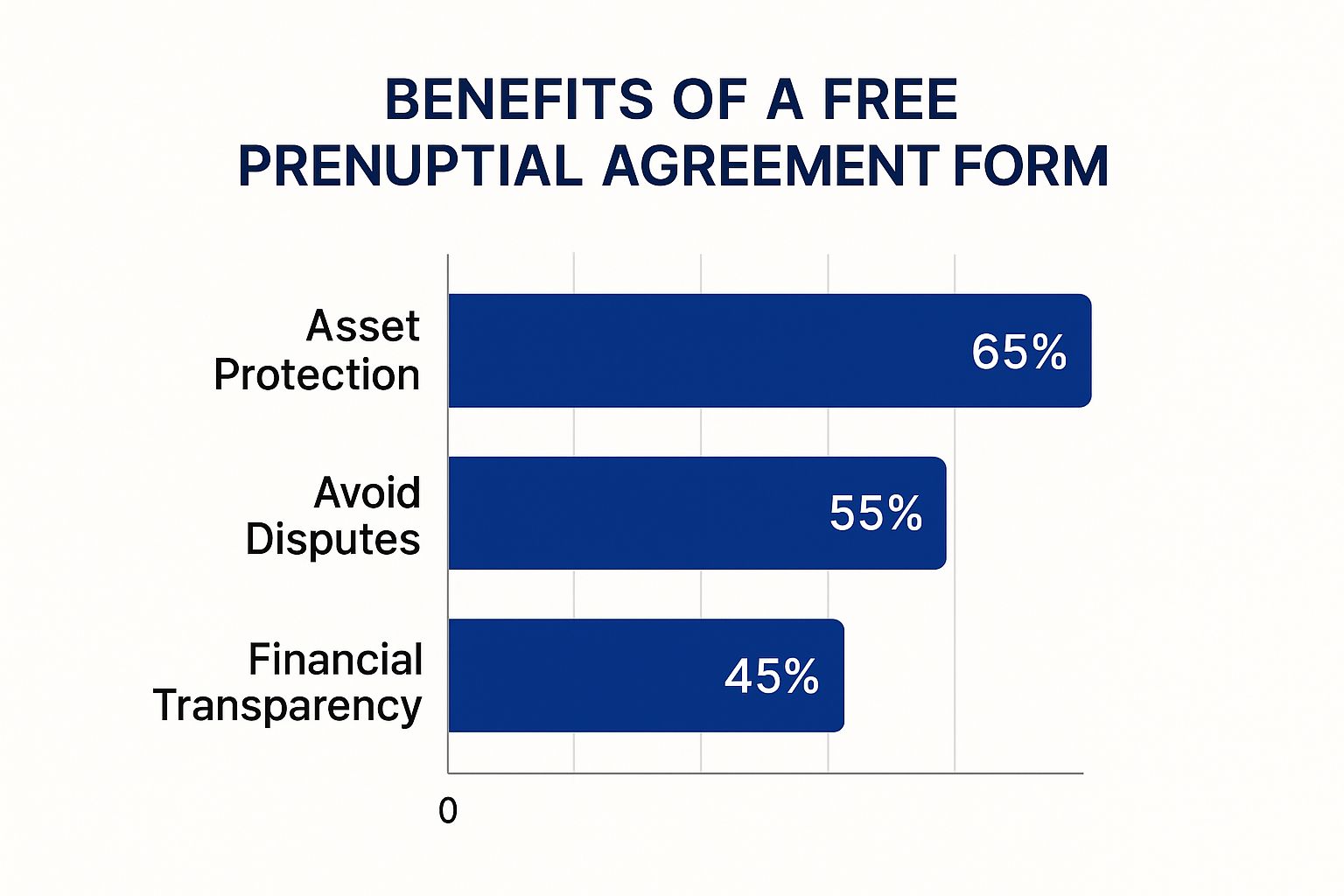

The infographic above illustrates the key advantages of using a free prenuptial agreement form. These benefits include asset protection, avoiding disputes, and promoting financial transparency. Asset protection is the most important benefit, with 65% of people prioritizing it, demonstrating the importance of protecting individual and premarital assets. Avoiding disputes (55%) and fostering financial transparency (45%) follow closely behind. These figures clearly show the value couples place on clarity and security in their financial planning.

The following table details the essential components of a legally sound prenuptial agreement. It explains the purpose of each component and why it is crucial for the agreement’s validity, as well as highlighting common mistakes to avoid.

Essential Components of a Valid Prenuptial Agreement

| Component | Purpose | Why It’s Essential | Common Mistakes |

|---|---|---|---|

| Full Financial Disclosure | Provides complete transparency regarding each party’s assets and liabilities. | Ensures both parties enter the marriage with a clear understanding of the financial situation. | Failing to disclose all assets and debts, including those held overseas or in complex investment vehicles. |

| Separate Property Definition | Clearly identifies assets owned individually before the marriage. | Protects premarital assets from being considered joint property in the event of a divorce. | Not clearly specifying what constitutes separate property, leading to ambiguity and potential disputes. |

| Marital Property Definition | Outlines assets acquired jointly during the marriage. | Establishes a framework for division of property acquired during the marriage. | Not clearly differentiating between separate and marital property, especially regarding assets that may increase in value during the marriage. |

| Debt Allocation | Specifies responsibility for pre-existing debts. | Protects each spouse from becoming liable for the other’s debts incurred prior to the marriage. | Failing to clearly allocate responsibility for pre-marital debts. |

| Business Interest Protection | Safeguards business ownership in the event of divorce. | Protects pre-marital business investments and future earnings from division in a divorce. | Not addressing the future of a business owned by one spouse, especially if the other spouse contributes to the business during the marriage. |

| Retirement Account Provisions | Dictates how retirement funds are handled in a divorce. | Ensures a fair and equitable division of retirement savings. | Not addressing retirement accounts, especially if significant contributions are made during the marriage. |

| Other Provisions (e.g., Pets, Education Expenses) | Addresses additional matters as agreed upon by the couple. | Provides clarity on matters beyond standard financial assets and debts. | Not including provisions for unique circumstances, such as pet ownership or anticipated future expenses like education costs. |

| Independent Legal Counsel | Each party has their own attorney review the agreement. | Ensures each spouse fully understands the implications of the agreement and that they are entering it voluntarily. | Not having separate legal representation, which can weaken the agreement’s enforceability. |

| Voluntary Agreement | Both parties enter the agreement freely and without coercion. | Protects against claims of undue influence or duress. | Pressuring one spouse into signing the agreement. |

This table highlights the key aspects of a valid prenuptial agreement, underscoring the importance of clarity, comprehensive disclosure, and independent legal advice for each party.

Ensuring the Validity of Your Prenuptial Agreement

Finally, for a free prenuptial agreement form to be legally binding, certain requirements must be met. Both parties must agree to the terms voluntarily, with complete disclosure of their financial situations. Each spouse should have a separate lawyer review the document. This ensures they understand the agreement’s effects and that it’s fair. These steps are critical to protect the prenup’s validity and prevent future legal challenges. Addressing these components proactively can provide long-term security and peace of mind.

Where to Find Legitimate Free Prenuptial Agreement Forms

Finding a free prenuptial agreement form online is easier than ever. However, this ease of access also brings a risk: encountering forms that are outdated, incomplete, or simply not legally sound. It’s essential to ensure any form you use complies with your state’s specific legal requirements.

Reliable Sources for Free Prenuptial Agreement Forms

Several reputable sources offer free prenuptial agreement templates that you can adapt to your situation.

- State Bar Associations: Many State Bar Associations offer free or low-cost legal forms, including prenuptial agreements. These forms are typically designed to meet state-specific laws, making them a reliable choice.

- Legal Aid Organizations: Non-profit Legal Aid Organizations often offer free legal documents and resources to low-income individuals. This can be an excellent option for those who qualify.

- Reputable Online Legal Websites: Several well-established online legal websites provide free basic prenuptial agreement forms. Look for sites with clear credentials and positive user reviews.

Identifying Red Flags and State-Specific Requirements

Not all free prenuptial agreement forms are equal. Be wary of forms that:

- Appear overly generic or simplistic: A good prenuptial agreement should address a variety of potential scenarios and be adaptable to your specific needs.

- Lack state-specific clauses: Prenuptial agreement laws vary by state. A generic form might not be enforceable in your area.

- Haven’t been recently updated: Laws change, so ensure the form you use reflects current legislation.

Younger couples are increasingly focused on financial planning within their relationships. 75% of HelloPrenup’s clientele are individuals aged 18-39, showcasing a proactive approach to protecting assets and normalizing early financial conversations. The median net worth of those seeking prenups is around $78,000, demonstrating that these agreements are not just for the wealthy.

Choosing the Right Template for Your Situation

When selecting a free prenuptial agreement form, consider factors such as:

- Your State’s Laws: Use a state-specific form to ensure compliance with local regulations.

- The Complexity of Your Finances: If you have significant assets, complex investments, or own a business, a simple template may not be sufficient.

- Your Comfort Level With Legal Documents: If you’re unsure about the legal terminology, consult with an attorney to understand the implications of each clause.

Using a free prenuptial agreement form can be a budget-friendly way to protect your financial future. By carefully evaluating your sources and choosing a form that fits your unique needs, you can create a solid legal foundation for your marriage. This preparation offers valuable peace of mind as you begin your journey together.

Transforming a Template Into Your Personalized Agreement

Finding a free prenuptial agreement form online is an excellent starting point. However, a generic template won’t provide the tailored protection you and your partner need. This section will guide you through the process of personalizing that form to create a document that truly reflects your unique situation. This involves open communication, meticulous documentation, and careful attention to detail.

Open Communication: The Foundation of a Strong Prenup

Before even thinking about filling out the form, sit down with your partner and have frank, open discussions. These conversations should encompass all aspects of your finances – where you stand now and your future aspirations. These conversations, while possibly difficult, are absolutely essential for establishing a solid base of trust and transparency. For example, don’t just discuss current assets and debts, but also talk about expected inheritances, career goals, and any long-term financial plans.

Gathering and Documenting Financial Information

After you’ve initiated these important conversations, gather all the necessary financial paperwork. This might include bank statements, investment account summaries, loan documents, and property valuations. Create a complete and accurate list of all assets and debts, ensuring both partners have a crystal-clear understanding of the combined financial picture. Accuracy at this stage is crucial.

Customizing the Free Prenuptial Agreement Form

With your financial information organized, you can start adapting the free prenuptial agreement form to your specific needs. This involves precisely defining separate and marital property, outlining how any pre-existing debt will be handled, and addressing any unusual circumstances. For instance, if one partner owns a business, make sure the agreement includes clauses to protect that business.

Addressing Specific Scenarios and Potential Challenges

Think ahead to potential future situations, such as having children or acquiring substantial assets. While child custody and support can’t be determined in a prenup, you can discuss issues like future educational expenses. Consider potential challenges as well. What if one partner anticipates a significant salary increase during the marriage? How will that affect the agreement? Proactively addressing these possibilities will help ensure the agreement remains relevant over the years.

Example: Protecting Inheritances

Suppose one partner expects to inherit a family business. The prenuptial agreement should clearly specify that this inheritance will remain separate property. This helps prevent future disagreements about the business’s ownership and protects the inheriting partner’s family legacy.

Reviewing and Finalizing Your Agreement

Once you’ve personalized the form, carefully review it with your partner. Make sure every single clause is understood and that you both fully agree to the terms. This process may involve several discussions and revisions. Remember, creating a well-drafted prenuptial agreement is a team effort. Finally, seek legal counsel from separate attorneys. This step is vital for ensuring the agreement is legally sound and enforceable in your state.

To help guide you through this process, use the checklist below. It breaks down each stage of creating your prenuptial agreement, outlining the necessary tasks, documents, and tips for successful completion.

Prenuptial Agreement Completion Checklist

| Stage | Tasks to Complete | Documents Needed | Completion Tips |

|---|---|---|---|

| Initial Discussion | Discuss financial goals, expectations, and concerns openly and honestly. | N/A | Create a comfortable and safe environment for open communication. |

| Information Gathering | Compile all financial documents, including bank statements, investment summaries, and debt records. | Bank statements, tax returns, investment portfolio summaries, property valuations, loan documents. | Organize documents systematically for easy access and review. |

| Form Completion | Fill out the free prenuptial agreement form, customizing clauses to reflect your specific needs. | Chosen free prenuptial agreement form, compiled financial information. | Pay close attention to the wording and ensure it accurately reflects your agreements. |

| Legal Review | Each partner consults with an independent attorney to review the completed form. | Completed prenuptial agreement form. | Prepare specific questions for your attorney regarding your state’s laws and the agreement’s enforceability. |

| Finalization & Signing | Sign the finalized agreement in the presence of witnesses and notaries as required by your state. | Finalized prenuptial agreement form, witnesses, notary public (if required). | Ensure all required parties are present and that the signing process adheres to legal requirements. |

By following these steps, you can transform a basic free prenuptial agreement form into a personalized, legally sound document that protects both your interests and solidifies your relationship’s financial foundation. This careful preparation is a valuable investment in your shared future, providing clarity and security as you begin your married life.

Making Your Free Prenuptial Agreement Legally Binding

Simply downloading a free prenuptial agreement form doesn’t guarantee its legal validity. Specific steps must be taken to ensure it will hold up in court. These requirements can differ from state to state, so understanding your local laws is essential. This includes everything from proper witnessing procedures to ensuring each party has independent legal representation.

Key Execution Requirements for a Valid Prenup

A legally sound prenuptial agreement depends on a few key elements. Timing is crucial. Most states require the agreement to be signed well in advance of the wedding date. This helps avoid accusations of pressure and allows ample time for review. Witnessing is another critical component. Prenuptial agreements generally need to be signed in front of witnesses, and sometimes, a notary public. These witnesses verify the voluntary nature of the signatures.

Independent legal review is also paramount. Each party should have their own attorney review the agreement. This ensures they fully understand the implications and are signing willingly. This safeguard protects against later disputes based on claims of unfairness or undue influence.

The Importance of Independent Legal Review

While a free prenuptial agreement form can offer initial cost savings, professional legal advice is vital for its enforceability. An attorney can help you navigate state-specific rules, clarify complex legal terminology, and ensure the agreement is equitable for both sides. This investment can prevent expensive legal battles in the future. More affordable legal options are available, such as consultation-only services or seeking guidance from legal aid organizations.

Common Pitfalls That Can Invalidate a Prenup

Even with a free prenuptial agreement form, several issues can make it unenforceable. Coercion, or pressuring a partner to sign, is a serious problem. If a court finds the agreement wasn’t entered into voluntarily, it can be deemed invalid. Inadequate financial disclosure, where one party hides assets or debts, is another frequent issue. Complete transparency is essential for a valid prenup. Unconscionable provisions, meaning terms that are excessively unfair to one party, can also invalidate the agreement.

Despite growing awareness of prenuptial agreements, many couples still don’t utilize them. Studies reveal 89% of couples aged 35-54 and 99% of those over 55 didn’t have a prenup. By understanding these potential problems and following the correct procedures, couples can significantly increase the chances of their free prenuptial agreement being legally binding.

When DIY Won’t Do: Recognizing When Professional Help Is Needed

While a free prenuptial agreement form can be a valuable starting point, certain situations call for professional legal guidance. Knowing when to seek expert help is crucial. It ensures your agreement is thorough, legally sound, and protects your interests effectively. This means recognizing the complexities of your unique situation and understanding the limits of DIY legal documents.

Complex Financial Situations

A free prenuptial agreement form might be adequate for couples with simple finances. However, if you have substantial assets, complex investments, international properties, or own a business, a DIY approach can be risky. For instance, navigating international assets across different legal jurisdictions requires specialized knowledge. Valuing and protecting business interests within a prenuptial agreement often requires professional valuation and legal structuring. If you’re using a free online prenuptial agreement form, consider best practices for data security, such as implementing appropriate API Authentication Methods.

Blended Families and Prior Marriages

Second or subsequent marriages often bring additional complexities, especially with children from previous relationships. A free prenuptial agreement form might not adequately address inheritance, estate planning, or the financial security of children from previous relationships. A family law attorney can navigate these issues and draft provisions that protect everyone. This proactive approach can prevent future disputes and provide clarity.

Significant Disparities in Income or Assets

When there’s a large difference in income or assets between partners, a DIY prenuptial agreement might not fully protect the less wealthy spouse. An attorney can help ensure the agreement is fair. This prevents one partner from being disadvantaged during a divorce. They can also help negotiate terms that address potential future financial changes, such as career advancements or inheritances. This foresight can prevent later amendments or legal challenges.

Cost-Effective Alternatives to Full Legal Representation

Getting professional help doesn’t always mean high legal fees. Several cost-effective options are available. Consultation-only services allow you to meet with an attorney for a limited time to get advice and review your drafted agreement. Document review services offer a more focused approach. An attorney reviews your completed prenuptial agreement form for legal issues and suggests revisions. Many communities also offer legal aid clinics with reduced-fee or pro bono services for those who qualify.

Finding Affordable Legal Resources and Asking the Right Questions

Several resources can help you find affordable legal help. Your local bar association often has a referral service. This connects you with local family law attorneys. Online directories and legal websites also offer information about attorneys’ fees and expertise. When meeting with a professional, prepare specific questions about your situation. This could include your state’s laws regarding prenups, the attorney’s experience, and their fee structure.

By knowing when professional help is necessary and exploring cost-effective options, you can ensure your prenuptial agreement is comprehensive. This is true even if it’s based on a free form. This proactive approach safeguards your financial future and builds a stronger foundation for your marriage.

Future-Proofing Your Prenuptial Agreement

A prenuptial agreement isn’t something you create and then forget about. Like any important relationship, it requires attention and care to stay relevant as your lives evolve together. This often-overlooked aspect of prenuptial agreements focuses on maintaining and updating them through life’s inevitable changes. This proactive approach can prevent potential legal issues later and ensure your agreement continues to serve its intended purpose.

Life Events That Warrant Revisiting Your Agreement

Several key life events might indicate a need to review and potentially revise your prenuptial agreement. Significant career changes, such as a substantial increase in one partner’s income, can shift the financial dynamics within the marriage. Large property acquisitions, like buying a second home or investment property, introduce new assets that the agreement may need to address. Expanding your family also brings financial changes and potential inheritance factors to consider.

For example, if one spouse launches a successful business after the marriage, the prenuptial agreement might need updating to clarify ownership and division of this new asset. Similarly, having children might necessitate a review to address issues like funding their future education. These revisions help keep the agreement current and aligned with your evolving family structure.

Modifying Your Agreement: Legal Mechanisms and Best Practices

Modifying a prenuptial agreement after marriage typically involves creating a post-nuptial agreement. This legally binding document lets you amend or add provisions to the original prenup. It follows similar legal requirements as the initial prenup, including full financial disclosure, voluntary agreement, and independent legal counsel for both parties. Regular reviews, perhaps every few years or after significant life changes, help ensure your agreement remains relevant and accurately reflects your current circumstances.

Navigating Conversations About Prenuptial Agreement Updates

Discussing changes to a prenuptial agreement requires sensitivity. Approaching these conversations with empathy, transparency, and a focus on mutual benefit can help preserve a healthy relationship. Frame the discussion as a collaborative effort to protect both partners’ interests. This open communication helps ensure the agreement remains a source of security, not conflict.

For instance, if one partner expects a large inheritance, they can explain their wish to update the prenuptial agreement to protect this asset for future generations. Openly discussing the agreement’s implications for both partners reinforces its role as a tool for fairness and transparency in the relationship.

By treating your prenuptial agreement as a dynamic document that evolves with your relationship, you ensure it continues to provide financial security and peace of mind throughout your marriage. This approach requires communication, planning, and occasional adjustments to ensure its continued relevance and effectiveness.

Are you ready to protect your future? Contact Aronov Law NY today for a free consultation: Schedule a Free prenuptial agreement Law Consultation

Free Legal Consultation

98-14 Queens Blvd